Loan Eligibility Checker

Enter Applicant Details

EDA Insights

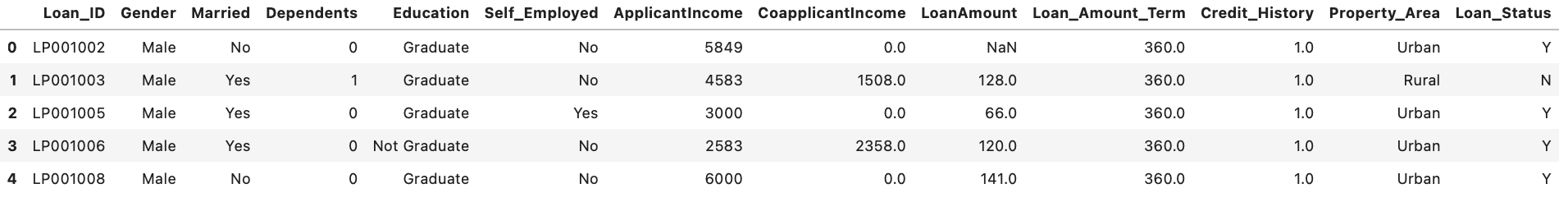

This is an exploratory data analysis (EDA) of the dataset, highlighting key patterns and relationships to better understand loan approval trends.

(The final insight shows that credit history has the strongest effect on loan approval.)

- The image shows that most applicants have low income, and the loan amounts are small for the majority.

- Applicants with a good credit history (Credit_History = 1) are significantly more likely to have their loans approved (Loan_Status = Y).

- For applicants with low ApplicantIncome and CoapplicantIncome, loans are often approved, but a combination of higher incomes and larger loans increases the likelihood of rejection.

- Applicant's income does not significantly affect the chances of loan approval. This contradicts the normal assumption that higher income should increase approval chances.

- Lower co-applicant income is associated with higher chances of loan approval, which does not make sense. This suggests that other features have a stronger influence than income.

- After combining ApplicantIncome and CoapplicantIncome into TotalIncome, the correlation with Loan_Status increases slightly, but not significantly.

- Both ApplicantIncome and CoapplicantIncome columns show extreme outliers, with values reaching 81,000 for ApplicantIncome and 41,667 for CoapplicantIncome.

- The maximum loan amount (700) is far outside the typical range.